When we talk about growth strategies, the focus often shifts towards market penetration, new product development, market expansion, partnerships, mergers, and acquisitions. It’s rare for us to discuss customer renewals (or, interchangeably, customer retention), an underestimated yet potent strategy for driving growth. This article will explore why customer renewal deserves a significant place in the growth playbook, supported by data-driven examples.

We will consider two scenarios for our analysis. In Scenario 1, three startups A, B, and C have unlimited access to funds to chase revenue goals. In Scenario 2, only a limited amount of external funding is available to these startups. This analysis has made certain assumptions, considering COGS, Opex, CAC, and Capex as fractions of revenue, and ‘overheads and other expenses’ as a combination of fixed costs and a fraction of revenue. All such assumptions are constant for them except the renewal ratios. All the figures are presented in INR Crs (1 Cr=10 million).

Scenario 1: Adequate Funding for Revenue Goals

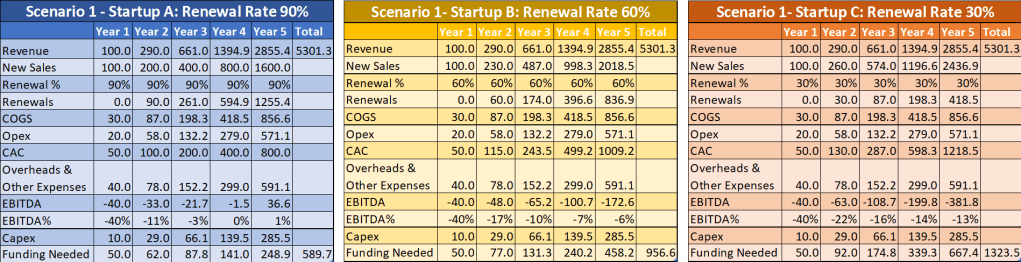

Financials of Startups A,B and C in Scenario 1

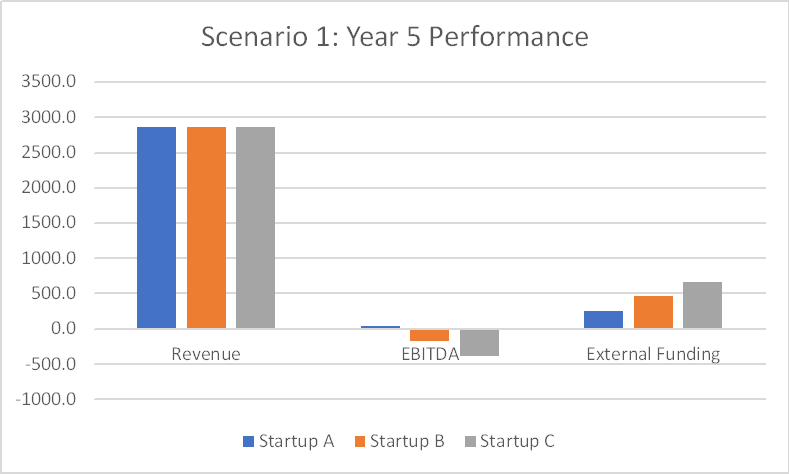

In this scenario, all startups chase ambitious revenue growth at a CAGR of 95%. Startup A, with a robust 90% renewal rate, shows an improving exit EBITDA of 1%, requiring total funding of INR 590 Cr over five years. The continuous enhancement in EBITDA predicts a promising future, positioning it as a potential wealth generator for shareholders.

Startup B, delivering a 60% renewal rate, achieves the same revenue growth but with a not-so-great exit EBITDA of -6%. Despite demanding a substantial INR 957 Cr in external funding, it grapples with challenges that demand adjustments in its unit economics for a turnaround.

Startup C, struggling with a 30% renewal rate, shows an exit EBITDA of -13% and an alarming funding requirement of INR 1324 Cr. With the slowdown in EBITDA improvement, this startup is on a path towards closure.

Scenario 2: Limited Funding

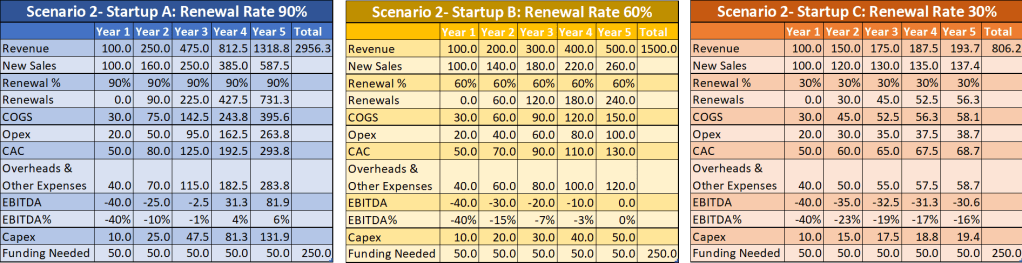

Financials of Startups A,B and C in Scenario 2

In this constrained funding scenario of INR 50 Cr per annum, the significance of customer retention becomes even more apparent.

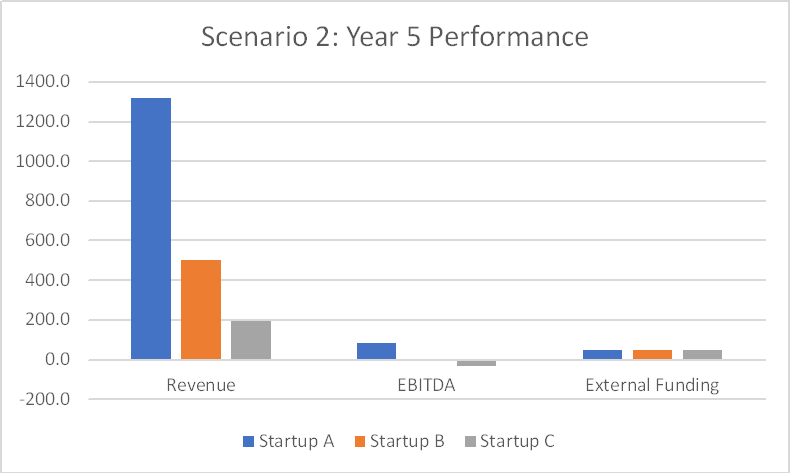

Startup A (90% renewal rate) achieves a commendable revenue CAGR of 68%, with an exit EBITDA of 6%, and a modest overall funding requirement of INR 250 Cr over five years. This startup is on the path to generating surplus cash, eliminating the need for additional funding in the short term.

Startup B (60% renewal rate) faces a more challenging journey, achieving a revenue CAGR of 38% and breaking even with an exit EBITDA of 0%. Potentially valued significantly less due to lower growth, this business requires a careful strategic overhaul to thrive.

Startup C (30% renewal rate) exhausts its resources with a dismal revenue CAGR of 14%, an exit EBITDA of -16%, and still burns INR 250 Cr. This declining business is sustained only by continuous fund infusion. It’s a money sink.

Conclusion: Customer Renewal as a potent Growth Strategy

In both scenarios, Startup A, with a higher renewal rate, outshines its counterparts in terms of revenue growth and profitability. It’s only fair to say that customer retention isn’t merely a strategy for profit and business sustainability; it is a powerful growth strategy. Unfortunately, it often takes a backseat in the startup world, overshadowed by the allure of chasing new customers. Nevertheless, the data unequivocally demonstrates that customer renewal efforts can be the key differentiator in a startup’s success. It’s time to give customer retention the attention it deserves in a startup’s growth journey – a strategy that’s not only financially sound but also growth-fueling.

In a world captivated by the thrill of chasing new frontiers, sometimes the genuine gold lies in retaining what you already have.

Leave a comment