Recently, Pocket FM raised US $103 mn funding at a valuation of US $750 mn. A big reason for the success it has seen is because of the good Product-Market Fit it has achieved, evident in its rapid growth and engagement metrics. Founded in 2019, the platform quickly became popular for its personalized content curation, leading to a remarkable 300% increase in user engagement within the first year. Their focus on pioneering binge-listening behaviour propelled PocketFM’s expansion to 20 countries, including the competitive US market. The platform’s revenue soared from Rs 17 crore in FY22 to Rs 148.7 crore in FY23 with an expected revenue of more than Rs 1000 Cr in FY24 showing the kind of customer love they are getting. This growth underscores the pivotal role of PMF in driving user growth, revenue surge, and sustainable retention strategies, solidifying PocketFM’s position as an industry leader.

What is Product-Market Fit:

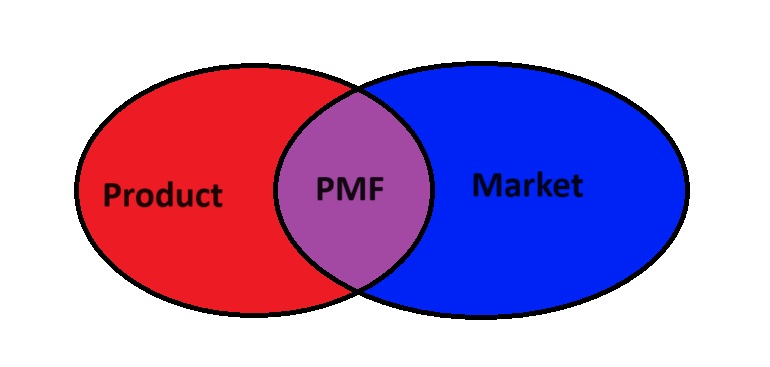

Product-Market Fit (PMF) refers to the stage in a startup’s journey where its product or service aligns perfectly with the needs and demands of its target market. It signifies that the startup has identified a compelling problem or need in the market and has developed a solution that resonates with customers to the extent that they are willing to use it extensively or pay for it. PMF is crucial for startups because it validates the viability and potential success of their business idea. Without PMF, startups risk investing resources in a product or service that fails to gain traction in the market, leading to wasted time, money, and effort.

Why we need PMF:

Startups need PMF for several reasons:

- Validation of Market Need: PMF confirms that there is genuine demand for the startup’s offering among its target audience. It demonstrates that the product or service addresses a real pain point or fulfills a significant need in the market.

- Customer Satisfaction and Retention: Achieving PMF ensures that customers are satisfied with the startup’s solution, leading to higher retention rates and long-term customer relationships. Satisfied customers are more likely to become loyal advocates and contribute to the startup’s growth through word-of-mouth referrals.

- Revenue Generation: PMF indicates that customers are willing to pay for the startup’s product or service, leading to revenue generation and sustainable business growth. It validates the startup’s monetization strategy and provides a pathway to profitability.

- Low Cost of Growth: A good PMF leads to sustainable unit economics. A good PMF will lead to high conversion rates, high retention rates, high engagement and high referrals leading to high Life Time Value of Customers (LTV) and low Cost of Customer Acquisition (CAC).

- Competitive Advantage: Startups with PMF gain a competitive advantage in the market by offering a differentiated and valuable solution that meets customer needs better than competitors. This allows them to capture market share and establish a strong market position.

- Investor Confidence: PMF is often a prerequisite for attracting investment from venture capitalists and other investors. Investors are more likely to fund startups that have demonstrated PMF as it reduces their risk and increases the potential for a return on investment.

How to Measure PMF:

There are several ways to measure PMF:

- Customer Surveys and Feedback: Startups can gather feedback from customers through surveys, interviews, or online reviews to understand their satisfaction levels, pain points, and willingness to recommend the product or service to others. There is a famous Sean Ellis test that prescribes an easy way to find out whether you have achieved PMF or not. As per this test, the most indicative question addressed to the customers is- How would you feel if you could no longer use our product?– Very disappointed- Somewhat disappointed – Not disappointed (it isn’t that useful). If the ratio of the answer “very disappointed” is more than 40%, then that means you have the product/market fit.

- Usage Metrics: Monitoring key usage metrics such as active users, retention rates, engagement levels, and frequency of use can provide insights into how customers are interacting with the product or service and whether it is meeting their needs effectively. Again, as per Sean Ellis, The North Star Metric (NSM) is a specific metric that best captures the core value your product delivers to customers. If your NSM is growing at a good pace, it means you are on a good path towards achieving PMF.

- Net Promoter Score (NPS): NPS measures customer satisfaction and loyalty by asking customers how likely they are to recommend the product or service to others. A high NPS indicates strong PMF, as satisfied customers are more likely to advocate for the product.

- Conversion Rates: Tracking conversion rates at various stages of the customer journey, such as sign-ups, free trials, and purchases, can help assess the effectiveness of the startup’s value proposition and its ability to convert leads into paying customers.

- Market Traction: Analyzing market traction through metrics such as revenue growth, market share, customer acquisition cost (CAC), and customer lifetime value (CLV) can indicate whether the startup has gained significant traction and momentum in the market, indicating PMF.

PMF serves as the compass guiding startups through the tumultuous seas of entrepreneurship. By understanding its significance, and mastering its measurement, startups can make informed decisions and iterate their offerings to drive sustainable growth and success.

Leave a comment